Inflation Slows More than Expected in November

December 13, 2022

This morning’s data showed that last month consumer prices grew at the slowest pace since July. The 0.1 percent increase in overall consumer prices followed two consecutive months of 0.4 percent growth. Before the report, economists expected inflation would slow more modestly to 0.3 percent. The slowdown in overall inflation benefited from a 2 percent decline in gasoline prices and a moderation in food price inflation. However, core CPI, which excludes these relatively volatile categories, increased just 0.2 percent in November, matching the slowest pace in 23 months.

The slowdown in Core CPI continues to be led by goods categories which fell 0.5 percent in the month. Used vehicle prices fell 2.9 percent from the prior month. Surprisingly, new vehicle prices were relatively flat after other indicators suggested that supply chain improvements were allowing auto production to pick up. It seems that higher financing costs in the prevailing high-interest rate environment entirely offset the disinflationary impact of increasing new vehicle supply. Prices in Core services categories increased at a slower 0.4 percent pace as medical care services declined 0.7 percent. Also, travel-related services like hotel rooms, rental cars, and airfares all declined from October, perhaps indicating that travel demand is slowing as we approach the end of the year.

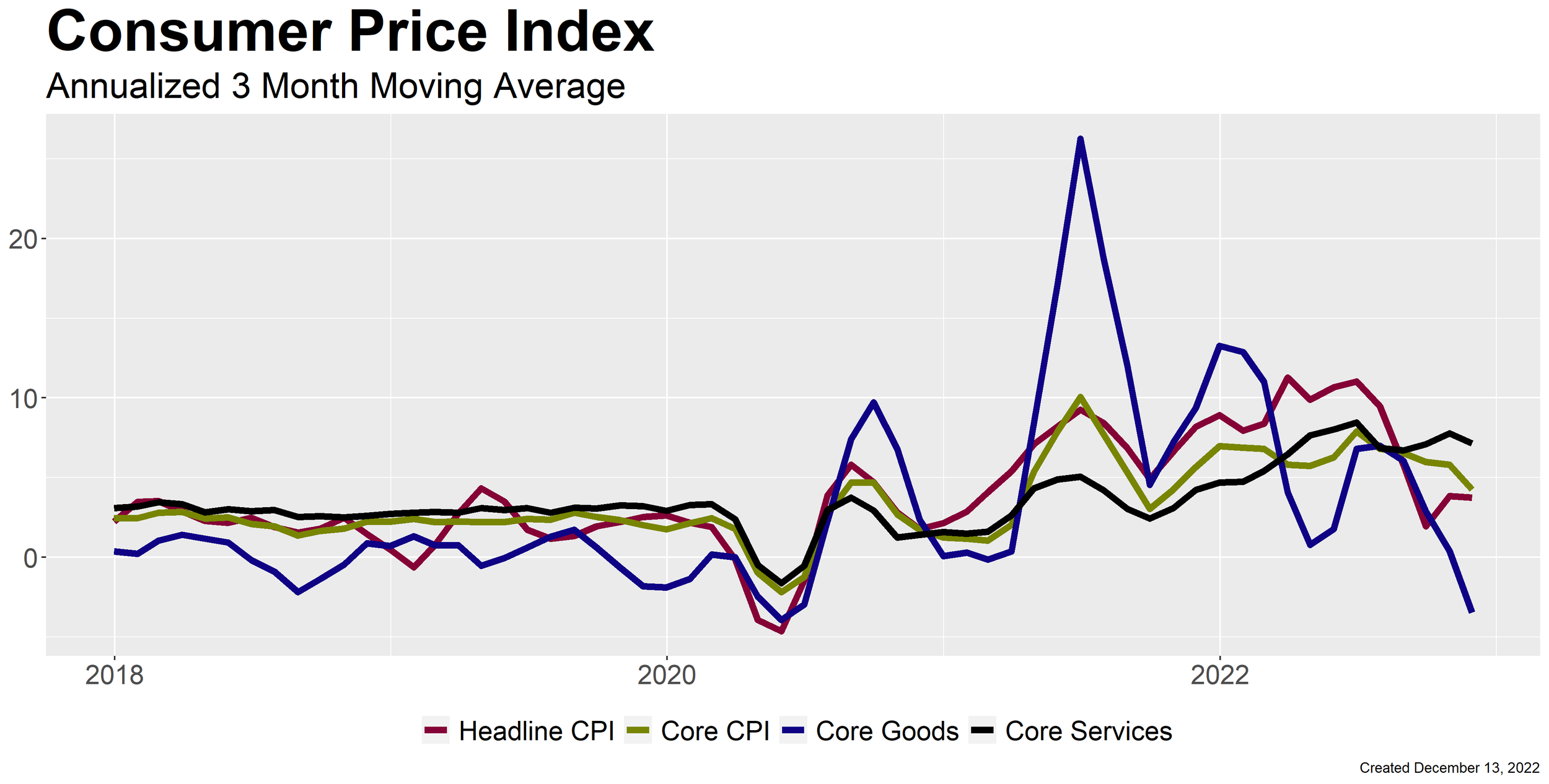

After incorporating the November data, annual growth in CPI slowed to 7.1 percent from 7.7 percent, and Core CPI slowed to 6.0 percent from 6.3 percent. At times, year-over-year growth rates can be overly influenced by base effects stemming from high or low growth in the comparable period, obscuring the underlying trend in the data. For this reason, we also compute annualized three-month moving average growth rates of the CPI data to compare. These data, shown in the chart below, suggest that the current underlying trend in inflation is even better than the year-over-year growth rates.

As the Federal Reserve meets today and tomorrow for the final time this year, policymakers will welcome this round of CPI data. Inflationary pressures appear to be diminishing, potentially allowing the Fed to slow the pace of rate increases after four consecutive 75 basis point increases. As a result, we expect they will increase the target Fed Funds rate by just 50 basis points tomorrow and possibly communicate a willingness to slow the pace of rate increases further early next year.

David Allen, CFA, CFP

Chief Investment Officer

DISCLAIMER

The information provided in our news and articles section is provided for informational purposes only. It is educational in nature and is not meant to be a recommendation for any specific investment or a substitute for specific individualized legal or tax advice. None of PAM’s representatives are suggesting that the reader take a specific course of action. Prior to making any investment or financial decision, an investor should seek individualized advice from personal financial, legal, tax, and other professionals. As a reminder, opinions and statements concerning market trends in our blog are based on current conditions and are subject to change without notice.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. Additionally, because of its narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies. Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All images of people, if any, presented in this article do not reflect any clients, and no compensation was provided to these individuals for the use of their image; it is not known if these persons, if any, are familiar with PAM or would endorse our services.